malaya-dubna.ru

News

Introduction Of Real Estate

This course teaches the fundamentals of real estate finance, management, and development. Lectures and supplemental videos introduce students to the full. This course offers a practical approach to understanding the steps necessary to purchase real property as part of an. An Introduction to. Real Estate. Real Estate Principles of Georgia. 1 of 56 Real Estate as a Career. Working as a real estate agent. Real estate agents work. Eventbrite - Royal T. Property Investments, LLC presents Dallas Texas: Introduction to Real Estate Investing - Thursday, January 18, | Thursday. Public REITs. Real Estate Investment Trusts are traded on the major stock exchanges. They own and operate real estate with the goal of producing income. They. What is commercial property? # Props Rental. Value £m. Offices. 11, Shops. In this article, we will discuss and break down what real estate investing is and the 9 main points to remember when investing in real. Learn the principles of real estate investment property finance. Course topics include permanent debt financing of income-producing properties such as. Module 1: Introduction to Real Estate Transactions. Owning a home has an almost mythical quality as part of the “American dream.” The process of negotiating. This course teaches the fundamentals of real estate finance, management, and development. Lectures and supplemental videos introduce students to the full. This course offers a practical approach to understanding the steps necessary to purchase real property as part of an. An Introduction to. Real Estate. Real Estate Principles of Georgia. 1 of 56 Real Estate as a Career. Working as a real estate agent. Real estate agents work. Eventbrite - Royal T. Property Investments, LLC presents Dallas Texas: Introduction to Real Estate Investing - Thursday, January 18, | Thursday. Public REITs. Real Estate Investment Trusts are traded on the major stock exchanges. They own and operate real estate with the goal of producing income. They. What is commercial property? # Props Rental. Value £m. Offices. 11, Shops. In this article, we will discuss and break down what real estate investing is and the 9 main points to remember when investing in real. Learn the principles of real estate investment property finance. Course topics include permanent debt financing of income-producing properties such as. Module 1: Introduction to Real Estate Transactions. Owning a home has an almost mythical quality as part of the “American dream.” The process of negotiating.

Designed for students who may intend to take additional real estate courses. Topics include real estate law, brokerage, property management, appraising. A comprehensive introduction to the potentially lucrative field of commercial real estate. The real estate market refers to a dispersed environment where properties are bought and sold. It is characterized by the difficulty of locating information. The difference between land, personal property, real property and real estate. Page 9. 9. Alabama State Department of Education, Career and Technical Education/. Real estate is property consisting of land and the buildings on it, along with its natural resources such as growing crops (e.g. timber), minerals or water. Tangible Asset: Real estate is a physical asset that you can see and touch. · Income Generation: Rental properties can provide a steady stream of passive income. Investment real estate is property owned to generate income or is otherwise used for investment purposes instead of as a primary residence. A one-day cpd accredited course to introduce you to the real estate sector, its characteristics and its importance to the general economy. Real estate investing involves the purchase, management and sale or rental of real estate for profit. Someone who actively or passively invests in real. Realbricks has democratized access to real estate investment. Through fractional ownership, beginners can invest in real estate with significantly reduced. Additionally, real estate encompasses the right of the owner to enjoy the land and its improvements. The features of the land, such as bodies of water, timber. Real estate data analytics empowers real estate professionals to make data-driven decisions about the sale, purchase, rental, or management of a physical. Unlike publicly traded real estate investment trusts (REITs) or real estate-related stocks, private real estate investments involve direct ownership or. The Introduction to Commercial Real Estate course introduces foundational commercial real estate concepts including market analysis, leasing fundamentals. COURSE DESCRIPTION · Learn about the real estate capital stack, and how debt is an important piece of any capital strategy · Build a mortgage amortization table. Introduction · Residential: The most common definition of residential real estate is an area developed for people to live in. · Commercial: Commercial real estate. This course provides an overview of the international real estate markets and investments. Case studies examine the impact of macroeconomic policies on real. Kaplan Real Estate Education offers the following real estate course for MN brokers: Introduction to Real Estate Investments ( credit hours). This course provides an overview of the international real estate markets and investments. Case studies examine the impact of macroeconomic policies on real. Study with Quizlet and memorize flashcards containing terms like real estate salesperson existence dependent on, broker, who/what can be a broker and more.

Check My Car Warranty

The service history will also reveal any repairs done under warranty. Check online databases: Some websites, such as Carfax and AutoCheck, provide a vehicle. Locate and write down your VIN number. This is the unique, character code comprised of letters and numbers that identifies your specific vehicle. · Check your. To check if your vehicle is still covered under the manufacturer's warranty, you will need to find your VIN, check your odometer, and find out the year the. After expiration, the Used Vehicle Limited Warranty provides additional coverage of 1 year or 10, miles. If the Basic Vehicle Limited Warranty has already. All warranty repairs include parts, labor and towing to the nearest CarBravo dealership (if necessary). Convenience check icon. Convenience. Get your vehicle. What is my current BMW warranty and/or BMW service or maintenance program coverage? When does it expire? · 1. Open the My BMW App · 2. Choose the car/shopping bag. View warranty information for your Chrysler vehicle. Check by VIN and download a copy of your extended, powertrain, or other FCA warranty coverage. Search for and download your Nissan vehicle's warranty information including CVT, powertrain, LEAF battery and Extended Protection Plans. Every new Ford vehicle comes with a New Vehicle Limited Warranty. You can check your warranty status by submitting your Vehicles Identification Number (VIN) or. The service history will also reveal any repairs done under warranty. Check online databases: Some websites, such as Carfax and AutoCheck, provide a vehicle. Locate and write down your VIN number. This is the unique, character code comprised of letters and numbers that identifies your specific vehicle. · Check your. To check if your vehicle is still covered under the manufacturer's warranty, you will need to find your VIN, check your odometer, and find out the year the. After expiration, the Used Vehicle Limited Warranty provides additional coverage of 1 year or 10, miles. If the Basic Vehicle Limited Warranty has already. All warranty repairs include parts, labor and towing to the nearest CarBravo dealership (if necessary). Convenience check icon. Convenience. Get your vehicle. What is my current BMW warranty and/or BMW service or maintenance program coverage? When does it expire? · 1. Open the My BMW App · 2. Choose the car/shopping bag. View warranty information for your Chrysler vehicle. Check by VIN and download a copy of your extended, powertrain, or other FCA warranty coverage. Search for and download your Nissan vehicle's warranty information including CVT, powertrain, LEAF battery and Extended Protection Plans. Every new Ford vehicle comes with a New Vehicle Limited Warranty. You can check your warranty status by submitting your Vehicles Identification Number (VIN) or.

A vehicle manufacturer's warranty can last between 2 to 7 years from the original purchase date. Check out our Free Warranty Check By VIN search tool and find. In addition, if your vehicle fails a smog check inspection, Alfa Romeo How do I use my limited vehicle warranty? To make a claim under your Alfa. MY GARAGE; VEHICLE RESOURCES; SERVICE; PARTS & ACCESSORIES; MY MITSUBISHI STORE cars and sport utility vehicles with extensive warranties. This list is. CARFAX Warranty Check provides an estimate of this vehicle's remaining warranty coverage. It does not take into account some vehicle history events such as. You can check if your vehicle is still under warranty. Find your bill of sale and VIN, get your mileage, and call a dealership to see if your car is still. Warranties include powertrain and the New Vehicle Limited Warranty (Basic). My Personal Information. © Kia America, Inc. ×. Information Collected. Input your Vehicle Identification Number to verify if your vehicle qualifies for this extended warranty. Hyundai is a registered trademark of Hyundai Motor. Getting the VIN and calling a dealer service department to ask is the only answer. Warranties actually do get cancelled sometimes and that is. Check if your vehicle has an open recall. Q&As. If I sell my car, does the new vehicle limited warranty transfer to the new owner? Yes. If the limited. You can check your warranty status by submitting your Vehicle's Identification Number (VIN) information in your Ford Owner account on the malaya-dubna.ru website. The factory coverage warranty period begins on the vehicle's in-service date, which is the first date the vehicle is either delivered to the original. Look up the details of all your vehicle's warranties through Mopar Vehicle Resources. Sign in to the Mopar Owners Site to find information on your vehicle. My Products. Find a Product; Log in to see your Products. Help Center Enter your VIN to access warranty information for your vehicle. VIN NUMBER. Motorcheck reports will tell you if a car is still under warranty, so you can have peace of mind when buying a new car. Run your check today! Q2: What to do when my car warranty is about to expire? · Look up your vehicle identification number (VIN) · Check Your Car's Odometer · Make an Appointment with. Getting the VIN and calling a dealer service department to ask is the only answer. Warranties actually do get cancelled sometimes and that is. Check out our limited warranty details by model year. VIEW ALL. INFINITI Do not sell or share my personal information · Terms of Use · Accessibility. Check if your vehicle has an open recall.. Q&As. If I sell my car, does the new vehicle limited warranty transfer to the new owner? Yes. Those limited. Perhaps the simplest way to check to see if your used car is under warranty is to use a service such as Carfax. You can go their website, and enter your VIN. Factory Warranty Check · First Name* · Last Name* · Email* · VIN* · Current Mileage* · Vehicle Purchase Date.

What Do I Need To Start My Own Bookkeeping Business

In addition, owning an accounting business typically requires a bachelors degree in accounting or finances—whereas owning a bookkeeping business does not. Accounting software proficiency; Personal and business finance basics; Basics of tax returns; Financial reports. The good news is that you can do bookkeeping. Gain years of on-the-job work experience, earn a couple of certifications, and then venture out to start your own business. You do not need to have advanced academic skills to do this course for starting your own bookkeeping business – basic education and your own interest and. Do you need errors and omissions insurance? What are current bookkeeping rates? How do you find clients? How do you create a bookkeeping business plan? How long. How to Start Your Own Bookkeeping Business · What is a bookkeeper? · What qualifications do I need? · Rules & Regulations · Design your business model · Research. Pretty much every small business needs a part time bookkeeper, so the clients are definitely out there. You could try a mailer, you can do it. To figure out how you'll make money as a virtual bookkeeper, you'll need to write a business plan. Preparing a business plan is essential for everyone should do. 1. Design your business model · 2. Getting set up · 3. Narrow your focus: who is your ideal client? · 4. Build a digital presence · 5. The importance of networks · 6. In addition, owning an accounting business typically requires a bachelors degree in accounting or finances—whereas owning a bookkeeping business does not. Accounting software proficiency; Personal and business finance basics; Basics of tax returns; Financial reports. The good news is that you can do bookkeeping. Gain years of on-the-job work experience, earn a couple of certifications, and then venture out to start your own business. You do not need to have advanced academic skills to do this course for starting your own bookkeeping business – basic education and your own interest and. Do you need errors and omissions insurance? What are current bookkeeping rates? How do you find clients? How do you create a bookkeeping business plan? How long. How to Start Your Own Bookkeeping Business · What is a bookkeeper? · What qualifications do I need? · Rules & Regulations · Design your business model · Research. Pretty much every small business needs a part time bookkeeper, so the clients are definitely out there. You could try a mailer, you can do it. To figure out how you'll make money as a virtual bookkeeper, you'll need to write a business plan. Preparing a business plan is essential for everyone should do. 1. Design your business model · 2. Getting set up · 3. Narrow your focus: who is your ideal client? · 4. Build a digital presence · 5. The importance of networks · 6.

You don't need a degree to start a bookkeeping business and it is really easy to learn the necessary skills. The cost of starting your own bookkeeping business will depend on the services you plan to provide and the initial equipment you will need to purchase. Management of spending, income, tax returns, and payroll are among the professional activities required by the accounting firm. To run a profitable accounting. You must have professional bookkeeping and/or accounting experience in addition to knowledge of different accounting programmes, such as QuickBooks. business cards (even though you hand them out on rare occasion), $20; a catchy business name (it doesn't have to be a great business name, e.g. “Sally's. Learn how to start, run, and operate your own profitable bookkeeping business. · Ability to choose how much you work: do you want to run your bookkeeping. The most important thing to do first is to find out who you want to target. Bookkeeping itself is a huge problem that business owners don't want. Excellent communication and organisational skills are key. You will also need to be detail orientated and client-centric, meaning your clients are the focal. You'll learn how to: * Choose the right equipment, even if you have a low or non-existent start-up budget. * Find good clients who not only. Assuming you already have a good laptop, you won't need to buy much – you can do the work straight from your computer. However, a laptop alone is unlikely to. Bookkeeping is one of the most lucrative businesses to start right now! In this article, you will learn everything you need to know to start your own. Do you dream of being your own boss and helping businesses thrive? The bookkeeping industry is booming, with small businesses increasingly seeking reliable. Passion First: Find joy in numbers and organization—it's the heart of bookkeeping. Skill Buffet: Hone your skills through courses and hands-on. How to Start Your Own Bookkeeping Business · What is a bookkeeper? · What qualifications do I need? · Rules & Regulations · Design your business model · Research. Step 1: Idealize Your Brand · Step 2: Create a Business Plan · Step 3: Take Bookkeeping Certification Courses · Step 4: Choose the Structure of Your Bookkeeping. American Institute of Professional Bookkeepers Certification (AIPB); National Association of Certified Public Bookkeepers (NACPB) Bookkeeper Certification. 9 Steps to Start a Bookkeeping Business · 1. Get Certified · 2. Research Your Market and Niche · 3. Craft a Business Plan · 4. Register Your Business · 5. Get. Practical steps to quit your day job & start a bookkeeping firm. Here are the practical steps you can start taking now, to build your own Bookkeeping Business. Professional Indemnity Insurance with creditable plans on their own. A certificate IV in bookkeeping, such as the ICI Diploma in Bookkeeping, is required. A BAS. You do not need to become a Certified Professional Accountant (CPA) to be a bookkeeper, though doing so will increase the variety of services that you can.

How Much Equity Can You Build In A Year

To determine how much equity you have, subtract the fair market value of your home by the outstanding balance on your mortgage. So if you have a $, home. Property value = $,; 80% of property value = $,; Loan value = $,; Usable equity = $40, How does equity work when buying a second home? This guide takes a look at what homeowners can do to build equity in their home as well as what they can do with the equity they've built up. Check your mortgage statements, contact your lender, or use an online home equity calculator to determine how much of the equity in your home you can access. Biweekly payments can reduce how much interest you pay and help build your home equity. Refinancing your year mortgage as a year loan, you'll build. Multiply your home value by the ideal LTV percentage of 80% to get your maximum. Once you've determined your available equity, you can decide which home equity. A home equity loan is a financing option where you borrow against the value built up in your home. In most cases, you can only borrow up to roughly 80% of the. After you buy a house, the value of your home equity can change and hopefully it will increase. How can your home equity increase? You can increase your home. Suppose you are five years into a year mortgage on your home. Furthermore, a recent appraisal or assessment placed the market value of your house at. To determine how much equity you have, subtract the fair market value of your home by the outstanding balance on your mortgage. So if you have a $, home. Property value = $,; 80% of property value = $,; Loan value = $,; Usable equity = $40, How does equity work when buying a second home? This guide takes a look at what homeowners can do to build equity in their home as well as what they can do with the equity they've built up. Check your mortgage statements, contact your lender, or use an online home equity calculator to determine how much of the equity in your home you can access. Biweekly payments can reduce how much interest you pay and help build your home equity. Refinancing your year mortgage as a year loan, you'll build. Multiply your home value by the ideal LTV percentage of 80% to get your maximum. Once you've determined your available equity, you can decide which home equity. A home equity loan is a financing option where you borrow against the value built up in your home. In most cases, you can only borrow up to roughly 80% of the. After you buy a house, the value of your home equity can change and hopefully it will increase. How can your home equity increase? You can increase your home. Suppose you are five years into a year mortgage on your home. Furthermore, a recent appraisal or assessment placed the market value of your house at.

Consider putting down the traditional 20% even though your excellent credit score allows you to go as low as 3% down. Lower down payments may look more. Will this program work for you? Purchasing a home without assistance may How much equity can I build with the city's down payment programs compared. Choose a shorter loan term. When paid on time and in full, a year mortgage can typically help you build equity faster than a year mortgage because you're. You can build equity faster by overpaying on your mortgage, either through Check with your provider how much you are allowed to overpay per year. Your home's equity is the difference between how much your home is worth and how much you owe on your mortgage. Many homeowners try to build equity in their homes simply by waiting for their home to grow in value as the market appreciates and as they pay it down year over. Homeowners can refinance a Texas cash-out loan into a conventional loan after one year, however it might not make sense to do so depending on the current. So, if your $, property increases in value by 12% in a year you'll have an extra $42, in equity. Plus the repayments made over the course of the loan. It is basically how much the home is worth minus how much is still owed on the mortgage. Having plenty of equity helps protect against foreclosure in case of. You can figure out how much equity you have in your home by subtracting the amount you owe on all loans secured by your house from its appraised value. As you pay off your loan over the years, your payments chip away at your principal loan balance, and you will build more equity. To calculate your home equity. It takes 5 to 10 years to build up 20% equity from the original % FHA down payment equity, if you have a 20 year mortgage. A home equity loan is a financing option where you borrow against the value built up in your home. In most cases, you can only borrow up to roughly 80% of the. To figure out how much equity you have in your home, subtract the amount you owe on all loans secured by your house from its appraised value. You usually need to have at least 20% in home equity to refinance. Refinancing can also give you an opportunity to get rid of a mortgage insurance premium (MIP). But how much is enough? Most financial professionals will recommend saving about one tenth of your annual income, which was sound advice when you could expect. years sooner. In turn, you will be building valuable equity faster. Tips for How to Leverage Home Equity. Before deciding whether or not to take out a HELOC. How to build equity in your home · Mortgage payments - Making payments as normal will pay off your mortgage so you owe less. · Property value increases – If your. If your $, home increases in value to $, after 10 years, for instance, you've achieved a $15, equity boost. Assume you paid off $30, of your. That gives you a $, principal balance and $60, in equity right off the bat. After making on-time payments for one year, say your principal balance is.

Pick Up And Move

Fast pick up & delivery on Craigslist, OfferUp & Facebook Marketplace. Get local help moving couches, sofas, mattresses and other large items found on any. Our professional local pickup and delivery service ensures the complete safety of all kinds of goods that you need to be moved. Moving to a different city allows you the space to explore who you are and what you want out of life. It's an opportunity to strengthen your self-relationship. Movepal helps you move large items locally, like couches, fridges, beds and more. Book an on-demand professional pick-up and delivery at a time that's most. New move-ins are allowed a maximum of three pick ups for cardboard boxes within the first six months. Cardboard boxes will not be picked up any other time. If. Flat Rate Movers NYC offer full-service storage pickup and delivery moving services. Call your near branch to help with your next storage move. PICKUP's fully vetted Delivery Pros are standing by––ready to move furniture or move mountains. To meet and exceed customer expectations. Every PICKUP. Here's a closer look at what to expect when your moving company in Texas provides you with a set of pick-up and delivery dates, also known as the delivery. Pick Up Movers is a Florida based moving company. We are fully Licensed and Insured company. malaya-dubna.ru Fast pick up & delivery on Craigslist, OfferUp & Facebook Marketplace. Get local help moving couches, sofas, mattresses and other large items found on any. Our professional local pickup and delivery service ensures the complete safety of all kinds of goods that you need to be moved. Moving to a different city allows you the space to explore who you are and what you want out of life. It's an opportunity to strengthen your self-relationship. Movepal helps you move large items locally, like couches, fridges, beds and more. Book an on-demand professional pick-up and delivery at a time that's most. New move-ins are allowed a maximum of three pick ups for cardboard boxes within the first six months. Cardboard boxes will not be picked up any other time. If. Flat Rate Movers NYC offer full-service storage pickup and delivery moving services. Call your near branch to help with your next storage move. PICKUP's fully vetted Delivery Pros are standing by––ready to move furniture or move mountains. To meet and exceed customer expectations. Every PICKUP. Here's a closer look at what to expect when your moving company in Texas provides you with a set of pick-up and delivery dates, also known as the delivery. Pick Up Movers is a Florida based moving company. We are fully Licensed and Insured company. malaya-dubna.ru

Pick-Up and Drop-Off Sign: During School Drop-Off and Pick-Up, Please Move Forward, Do Not Leave Vehicle Learn More Ships Tuesday. Sign orders over $ Only people who act, face and overcome challenges, are the ones who are able to solve their problems, to pick up the pieces when life falls. Services · Full-service moving company · Junk Removal & Trash Pickup · Hourly moving & packing services · Donation Pickups. Order Pick-Up Drop-Off Area Move Forward Sidewalk Sign. Highly-durable material. Reliable and secure process and packaging. Manufactured in USA. Our app makes it easy for you to order a micro-move; it includes one dude and one pick up truck. Purchased a new couch and need it delivered? International Sea & Air Shipping offers on-site pick-up services and door-to-door service for your convenience during your international relocation. Experienced & Reliable. We are one of the top moving companies in the industry. We have experience and knowledge under our belts. Each mover is trained on. Please send a Request through theResident Center with your preferred key pick up time. They are available after 8am on your Lease Commencement date from our. Moving is the perfect time to donate items you no longer need. Several charitable organizations make it simple for you to donate items to be repurposed or. We Pick Things Up and Put Them Down is a local moving company in Philadelphia, Pennsylvania. We offer knowledgeable movers grounded in tenacity to care for. When You Want It Pick-Up NOW! We offer same day pick-up and delivery and moving services services in St. Petersburg, Tampa Bay and surrounding areas in FL. We offer all moving related services. Local Moves We offer free moving consultations, free onsite estimates, and guaranteed pricing options. We'll deliver a portable moving container to your door, you can pack at your own pace, then we'll pick it up and deliver it to your new home, all on your. At the end of the turn in which another Pokémon used a one-time-use item (including throwing an item with Fling or using Natural Gift), a Pokémon with Pickup. The moving crew showed up on time and were friendly, fast, courteous and professional. the move was done in the exact same time as they estimated. I will be. Used Moving Boxes Pickup · We require a minimum of 20 boxes for a pickup · We only pickup Gentle Giant/Top Box moving boxes · All boxes must be broken down and. International Sea & Air Shipping offers on-site pick-up services and door-to-door service for your convenience during your international relocation. Services - Pick Up Movers. Local Moving. Pick Up Movers Photos. Broken mirror move (sq ft of furniture, tvs, boxes) from PA to FL and could not be. Pickup trucks aren't just for moving, use our pickup truck to tow your boat to the lake, or tow your personal vehicle or motorcycle to the mechanic.

How To Start Buying Bonds

There are two ways to make money by investing in bonds. The first is to hold those bonds until their maturity date and collect interest payments on them. Bond. TreasuryDirect · Create your TreasuryDirect account to purchase securities. · Select the Buy Direct tab. · Follow the prompts to choose a Treasury bond, the amount. One of the simplest ways to invest in bonds is by purchasing a mutual fund or ETF that specializes in bonds. Government bonds can be purchased directly through. investment and commercial banks. Once new-issue bonds have been priced and sold, they begin trading on the secondary market, where buying and selling is. What is a corporate bond? A bond is a debt obligation, like an Iou. Investors who buy corporate bonds are lending money to the company issuing the bond. When it comes to bonds (also referred to as fixed income), there's a general rule of thumb: The more conservative you are as an investor, the higher proportion. You can buy bonds in a similar way to how you might buy stocks. If you have an account at a broker, you can log in and navigate to the bond trading platform. Buying and Investing in Bonds ; Get to know the different types of bonds. Treasury bonds · Treasury Bonds benefits and risks ; Municipal bonds. Municipal bonds. Key takeaways · Things to keep in mind when considering bonds · Decide whether you want to buy individual bonds or bond funds · Figure out what type of bonds you. There are two ways to make money by investing in bonds. The first is to hold those bonds until their maturity date and collect interest payments on them. Bond. TreasuryDirect · Create your TreasuryDirect account to purchase securities. · Select the Buy Direct tab. · Follow the prompts to choose a Treasury bond, the amount. One of the simplest ways to invest in bonds is by purchasing a mutual fund or ETF that specializes in bonds. Government bonds can be purchased directly through. investment and commercial banks. Once new-issue bonds have been priced and sold, they begin trading on the secondary market, where buying and selling is. What is a corporate bond? A bond is a debt obligation, like an Iou. Investors who buy corporate bonds are lending money to the company issuing the bond. When it comes to bonds (also referred to as fixed income), there's a general rule of thumb: The more conservative you are as an investor, the higher proportion. You can buy bonds in a similar way to how you might buy stocks. If you have an account at a broker, you can log in and navigate to the bond trading platform. Buying and Investing in Bonds ; Get to know the different types of bonds. Treasury bonds · Treasury Bonds benefits and risks ; Municipal bonds. Municipal bonds. Key takeaways · Things to keep in mind when considering bonds · Decide whether you want to buy individual bonds or bond funds · Figure out what type of bonds you.

Strategies have evolved that can help buy-and-hold investors manage this inherent interest rate risk. One of the most popular is the bond ladder. A laddered. Bonds. “Bonds” shall refer to corporate debt securities and U.S. government securities offered on the Public platform through a self-directed brokerage account. All Treasury marketable securities require a minimum bid of $ You may bid in increments of $ up to a maximum of $10 million for a non-competitive bid. The TresuryDirect website, which is run by the U.S. government, is the only place you can electronically buy and redeem Treasury bonds. You can also buy them. You've got the basics of it. Go to Fixed Income, then click on the Bonds tab, then select which type of bond you want: Treasuries will have the. You can buy or sell Exchange-traded Australian Government Bonds (eAGBs) on the Australian Securities Exchange (ASX) in the same way you buy or sell ASX listed. Get Started Investing Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. How can I buy bonds? · From a bank or broker · From the U.S. Department of the Treasury · Via a mutual fund or exchange-traded fund (ETF) · Find bonds that are. These low-risk bonds are available in denominations from $25 or more, to the penny. You could buy a bond for, say, $ Other Treasury Securities are. Bonds are a core element of any financial plan to invest and grow wealth. If you are just beginning to consider investing in bonds, use this section as a. Why buy bonds? Bonds are issued by governments and corporations when they want to raise money. By buying a bond, you're giving the issuer a loan, and they. What Is a Bond? A bond is a fixed-income instrument and investment product where individuals lend money to a government or company at a certain interest rate. In addition to purchasing bonds directly, you can also invest in a bond fund. Bond funds give you access to various types of bonds so you can invest in a mix. Why Invest in Bonds? · Higher returns than bank deposits. Bonds typically pay a higher yield (return) than bank deposits of a similar term (tenor). · Regular. Electronic Bonds Paper Bonds (Series I only). A Great Investment for Everyone. U.S. Savings Bonds offer a safe, easy way to save money while making a solid. Today, coupon payments on U.S. bonds are often directly deposited into the investor's bank or brokerage account. They are typically made every six months. There are a number of considerations that need to be made when investing. A good starting point is to determine what type of investor you are. What is your. TreasuryDirect · Create your TreasuryDirect account to purchase securities. · Select the Buy Direct tab. · Follow the prompts to choose a Treasury bond, the amount. Borrowers issue bonds to raise money from investors willing to lend them money for a certain amount of time. When you buy a bond, you are lending to the issuer. Investors can buy a variety of bonds, including corporate, municipal, and government bonds, through their brokerage account. Bond prices vary depending on.

Are 401k Loans A Good Idea

But, borrowing from your future should always be your last option and one you don't exercise until you've considered all the risks. Like what you're reading? A (k) loan will generally be better than taking a loan with a third party—even a home equity line of credit—in that you're paying the (k) loan interest. A (k) loan may be a better option than a traditional hardship withdrawal, if it's available. In most cases, loans are an option only for active employees. A (k) loan comes out of your own retirement account, while a personal loan is something you get from a bank, credit union, or other lender. There is one way you can ruin your chances of retirement even if you are saving for retirement, and it's by taking a (k) loan. A (k) loan might make sense if you are borrowing to pay down payment for your primary residence. The (k) loan won't affect your chances of qualifying for. Advantages of (k) loans · No credit checks. A low credit score won't result in a rejected application. · Low interest rates. You'll pay a modest interest. Are you thinking about getting a K Loan? Do you currently have a K loan? Here are the pros and cons you need to know. Your (k) plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan from your (k). But, borrowing from your future should always be your last option and one you don't exercise until you've considered all the risks. Like what you're reading? A (k) loan will generally be better than taking a loan with a third party—even a home equity line of credit—in that you're paying the (k) loan interest. A (k) loan may be a better option than a traditional hardship withdrawal, if it's available. In most cases, loans are an option only for active employees. A (k) loan comes out of your own retirement account, while a personal loan is something you get from a bank, credit union, or other lender. There is one way you can ruin your chances of retirement even if you are saving for retirement, and it's by taking a (k) loan. A (k) loan might make sense if you are borrowing to pay down payment for your primary residence. The (k) loan won't affect your chances of qualifying for. Advantages of (k) loans · No credit checks. A low credit score won't result in a rejected application. · Low interest rates. You'll pay a modest interest. Are you thinking about getting a K Loan? Do you currently have a K loan? Here are the pros and cons you need to know. Your (k) plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan from your (k).

If there's a loan provision in place, you can avoid making an early withdrawal from your (k), which would mean you'd have to pay income taxes and a penalty. In most cases, taking a (k) loan is not a good idea. Unless a (k) loan is absolutely necessary, you may be better off looking elsewhere for financial. Borrowed funds are taxed twice. You earn and pay taxes on wages and use those after-tax funds to repay the loan. During retirement, you again pay taxes, this. As much as you may need the money now, by taking a distribution or borrowing from your retirement funds, you're interrupting the potential for the funds in your. It depends on the level of emergency to pay off the debt. Borrowing everything from a k to pay off a car loan at 4%? That's not a good idea. Unlike regular (k) salary deferrals, loan repayments will come out of your after-tax income. When the plan distributes the repaid amounts to you, they will. A (k) loan allows you to take out a loan against your own (k) retirement account, or essentially borrow money from yourself. While you'll pay interest. However, (k) loans are not without their drawbacks, as pulling money from your retirement accounts can mean diminishing the opportunity to let your savings. Taking a loan from your (k) can be an affordable way to quickly access a large amount of cash with relatively little hassle. But it's not without risk. A (k) plan will usually let you borrow as much as 50% of your vested account balance, up to $50, (Plans aren't required to let you borrow, and may impose. So no, mot a zero % loan. Taking money from k should be for preventing foreclosure or somev tragic event not lifestyle. A (k) loan is different from other types of loans in that you are both the lender and the borrower. The good news is it makes these loans easier to qualify. Interest Rates. A (k) loan interest rate is usually a point or two above the prime rate. · Taxes. The great advantage of a typical (k) is that the money. It's generally not a good idea to borrow from your (k) unless you're purchasing an asset (like a house) that increases in value over time and has tax. Taking out a (k) loan can be easy and convenient. There's no credit check; no limitations on using the funds; and no taxes are owed on the loan amount. The good thing about taking a loan K is that, the interest paid on the loan comes to you. That means you enjoy the loan and also get back the. There are some perks to it, including the fact that you don't need good credit to qualify for a (k) loan and you pay interest to yourself instead of a. Here's why it's generally NEVER a good idea to borrow from your retirement account: For example, the interest on student loans doesn't start accruing until. Although the money in a k comes from pre-tax contributions, the retirement plan loan is repaid from after-tax dollars, leading to double-taxation on the loan. Profit-sharing, money purchase, (k), (b) and (b) plans may offer loans. To determine if a plan offers loans, check with the plan sponsor or the Summary.

Which Airlines Are Refundable

Top 5 U.S. Airlines JetBlue, Southwest, United, Delta, and Alaska provide travel flexibility with refundable tickets & saves you paying cancellation fees. Choosing to Refund will cancel the whole ticket and all flights. For tickets bought on malaya-dubna.ru and the inbound travel has a past date or cancelled. Our refundable fares come with unlimited changes and the ability to cancel up until the time of departure for a full refund to the original form of payment. If your KLM flight was delayed or cancelled, or your baggage was delayed or damaged, you might get a cash refund or compensation. View your options. US airlines that offer refundable tickets include Southwest, JetBlue, Delta, United, and American. Here's why you should consider the potential for refunds. A specified fee will be charged for refunds to flight tickets that have been purchased (not applicable when only a reservation has been made). Fully or partially unused refundable tickets may be submitted to American Airlines for possible refund. Many tickets contain fare restrictions that limit their. A refundable fare means that if you cancel, you'll receive a refund to your original form of payment, minus the airline cancellation fee. Hour Risk-Free Cancellation Process Delta will process the refund of your ticket when canceled within 24 hours of purchase, however, some banks or credit. Top 5 U.S. Airlines JetBlue, Southwest, United, Delta, and Alaska provide travel flexibility with refundable tickets & saves you paying cancellation fees. Choosing to Refund will cancel the whole ticket and all flights. For tickets bought on malaya-dubna.ru and the inbound travel has a past date or cancelled. Our refundable fares come with unlimited changes and the ability to cancel up until the time of departure for a full refund to the original form of payment. If your KLM flight was delayed or cancelled, or your baggage was delayed or damaged, you might get a cash refund or compensation. View your options. US airlines that offer refundable tickets include Southwest, JetBlue, Delta, United, and American. Here's why you should consider the potential for refunds. A specified fee will be charged for refunds to flight tickets that have been purchased (not applicable when only a reservation has been made). Fully or partially unused refundable tickets may be submitted to American Airlines for possible refund. Many tickets contain fare restrictions that limit their. A refundable fare means that if you cancel, you'll receive a refund to your original form of payment, minus the airline cancellation fee. Hour Risk-Free Cancellation Process Delta will process the refund of your ticket when canceled within 24 hours of purchase, however, some banks or credit.

If you cancel, you're eligible to receive % of your ticket value as a refund to your original form of payment. A Southwest flight credit from a previous. For tickets purchased via China Airlines website and to/from USA or from Korea, a full refund without service charge will be given if the refund request is. Can I change my flight or get a voucher refund for my ticket? At Iberia we offer different options for changing your flight if your plans change. There are. Ticket purchased on Japan Airlines American Region website (malaya-dubna.ru) can be refunded without penalty if request within a 24 hour time period. Compare refundable flight tickets from over airlines! Find the best deals and make a refundable flight reservation with Alternative Airlines. Our refundable fares come with unlimited changes and the ability to cancel up until the time of departure for a full refund to the original form of payment. Need assistance with refunds or travel funds with Avelo Airlines? Find guidance on our refund policies and how to manage your Avelo travel funds for future. If your flight is at least 7 days away from the time of booking, you are entitled to a full refund within the first 24 hours of booking with no fee. Cancellation policies vary depending upon the fare purchased, including whether the ticket was purchased through Cape Air, a partner airline, or agency. A flyer is entitled to a flight cancelation refund for a non-refundable flight ticket only if the flight has been canceled or rescheduled with a significant. You have 24 hours from the time you first buy your ticket to cancel for a refund if you booked at least 2 days before departure. After 24 hours, refunds to your. However, the reality is slightly different. Non-refundable fares, when canceled, typically result in the value of the ticket being returned as an e-credit to. A refundable American Airlines ticket lets you receive a full refund anytime before departure, with any ticket type. Searching for refundable flights with. Fill out this form to request a refund of your ticket. We will review your request and get back to you as soon as possible. Silver offers three types of fares to give travelers the flexibility that they need throughout their journey: Refundable, Freedom, and Escape. If you cancel your booking within 24 hours of booking, you can choose either to a) receive a method-of-payment refund or b) hold the value of the ticket as a. Well, the airline would prefer that you buy a very expensive refundable ticket. These are typically three or four times as expensive as a non-refundable. So. flights originating from the United States, Canada and the Caribbean. Please note that Basic Economy tickets remain non-changeable and non-refundable in most. Each Airline has several fare types available in their system. Two (2) of the most common fare types and nonrefundable and refundable airfares. NON REFUNDABLE. The airline may not notify you of a qualifying schedule change, so if you've purchased a non-refundable fare that you would like to refund, be sure the check.

Career And Finance

If you are looking for a career with high-income potential and plenty of job opportunities, finance can be a rewarding field. Many people who excel in this. Benefits of finance careers. Before climbing the corporate ladder of a finance career, you want to ensure it's worth it. We can't tell you if finance is the. Ever wonder if finance is a good career path for you? View CFA Institute's investment & finance job summaries to learn more about financial industry jobs. Careers in Finance Panelists Rich focuses on client service, financial planning and tax consulting services. A veteran tax specialist and personal. Search 3 Careers in Finance available. View and apply to positions. Explore Finance & Accounting Related Careers · Chief Financial Officer (CFO) CFOs are key executives responsible for managing the financial actions of a company. In summary, a finance career can be highly rewarding for those with the right skills and a strong work ethic, offering diverse opportunities and. Your path to a career in finance involves earning a degree—a bachelor's is what employers most often look for—then exploring the myriad jobs available in the. Careers in Finance · Commercial Banking · Investment Banking · Financial Planner · Insurance Agent · Public Accounting · Hedge Fund Manager · Venture Capitalist. If you are looking for a career with high-income potential and plenty of job opportunities, finance can be a rewarding field. Many people who excel in this. Benefits of finance careers. Before climbing the corporate ladder of a finance career, you want to ensure it's worth it. We can't tell you if finance is the. Ever wonder if finance is a good career path for you? View CFA Institute's investment & finance job summaries to learn more about financial industry jobs. Careers in Finance Panelists Rich focuses on client service, financial planning and tax consulting services. A veteran tax specialist and personal. Search 3 Careers in Finance available. View and apply to positions. Explore Finance & Accounting Related Careers · Chief Financial Officer (CFO) CFOs are key executives responsible for managing the financial actions of a company. In summary, a finance career can be highly rewarding for those with the right skills and a strong work ethic, offering diverse opportunities and. Your path to a career in finance involves earning a degree—a bachelor's is what employers most often look for—then exploring the myriad jobs available in the. Careers in Finance · Commercial Banking · Investment Banking · Financial Planner · Insurance Agent · Public Accounting · Hedge Fund Manager · Venture Capitalist.

This article covers an overview of the qualifications, requirements and the various roles you can look for in finance. Careers in finance span many different types of organizations, from big investment banks to smaller private equity firms, insurance companies, boutique wealth. Careers in Finance. Whether you're eyeing a job as an investment banker, an accountant, or any type of financial analyst, you might need some help getting. And while you don't need to have a business background in order to successfully go into finance, mastering financial concepts is a must to demonstrate your. 7 Career Paths in the Finance Industry · Financial Technology · Investing · Mortgages and Lending · Financial Advisory · Accounting and Tax · Risk Management. As part of the team, you can have the opportunity to learn and use the latest data tools and technologies and explore a range of roles to grow your career. financial professionals interested in careers in treasury and finance. In financial field and how she navigated her career journey. AFP: Share your. Career Map · Within the finance and banking industry, no one size fits all. · The purpose of the CFI Career Map is to give you real-world insight into the many. Career Opportunities in Finance · Local, national and international corporations · International organizations such as the World Bank · Treasury department of. Finance positions use a range of skills, from quantitative analysis to negotiation. It is a fast-paced career with a competitive job market. Students with. Find the best finance and tech jobs at eFinancialCareers: the no. 1 job site for finance and tech professionals. Apply for your next role at. What you'll do: As a personal financial planner, you'll meet with individual clients to review their finances and budgets and set financial goals. Your clients. Starting your finance career with some education in the field is often a good idea. It's useful to have either an associate, bachelor's, or master's degree. Learn and develop your skills by doing a master programme, completing the Chartered Financial Analyst ® qualification, or taking online courses. There are many different options to work in finance. One can pursue finance roles within a specific organization or work in various capacities within the. Yes, finance is still a good career path, but it will probably not be as good relative to other careers as it has been over the past few decades. We'll give you a complete breakdown of the world of corporate finance careers here, including: The King of the Castle in the Corporate Finance Career Path. 1. High earning potential. Careers in financial services pay a great deal more than most other fields, with some of the highest paying entry-level positions. Planning, services for financial and investment planning, banking, insurance, and business financial management. Career Pathway. Code. Occupation. Accounting. The financial industry is easy enough to break into, but carving out a viable long-term career is tough. To succeed in this industry, one must have.

Brief History Of Ai

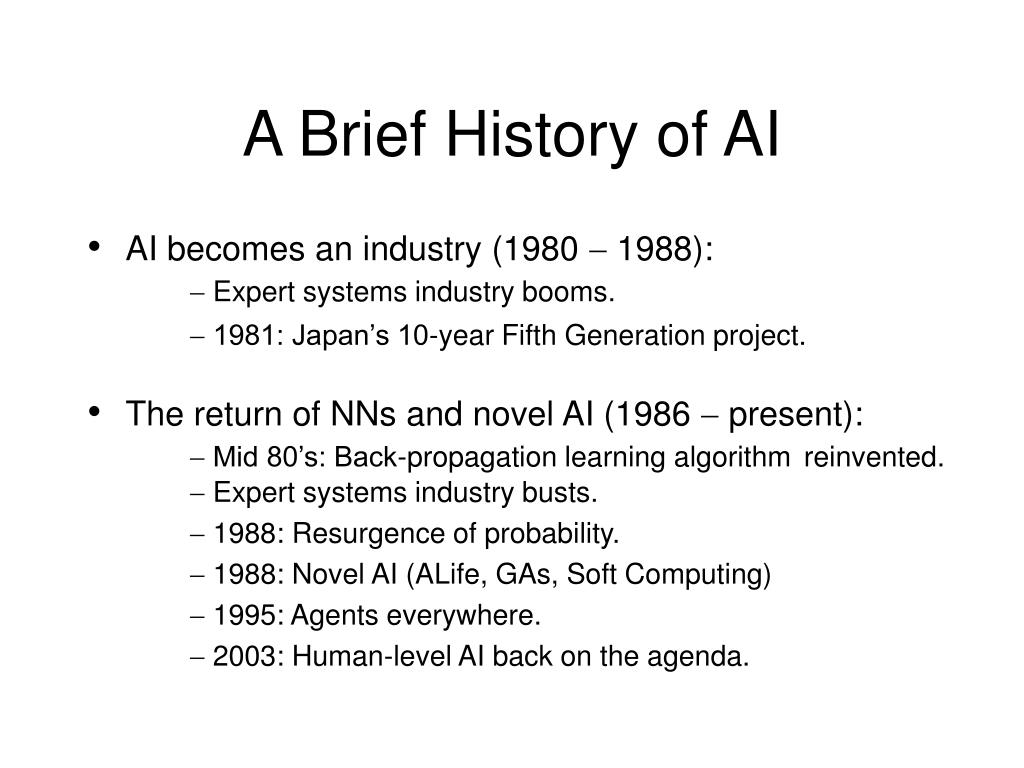

The field of Artificial Intelligence (AI) was officially born and christened at a workshop organized by John McCarthy in at the Dartmouth Summer Research. Explore a timeline of the history of artificial intelligence (AI). Learn view citation[1]“The Brief History of the ENIAC Computer.” Smithsonian. The term artificial intelligence (AI) wasn't coined until the midth century, but the idea of building intelligent systems has fascinated human beings for. The father of AI – John McArthy () John McCarthy is the highlight of our history of Artificial Intelligence. He was an American Computer Scientist, coined. Artificial Intelligence History The term artificial intelligence was coined in , but AI has become more popular today thanks to increased data volumes. Artificial intelligence (AI), the ability of a digital computer or computer-controlled robot to perform tasks commonly associated with intelligent beings. When was artificial intelligence invented? The term 'artificial intelligence' was first coined at a conference at Dartmouth College, in Hanover, New Hampshire. In the beginning, Artificial Intelligence was developed on the basis of neural networks. In , Frank Rosenblatt went on to create Perceptron. In the late s and early s, the development of the first electronic computers provide the necessary hardware basis for AI research. The creation of the. The field of Artificial Intelligence (AI) was officially born and christened at a workshop organized by John McCarthy in at the Dartmouth Summer Research. Explore a timeline of the history of artificial intelligence (AI). Learn view citation[1]“The Brief History of the ENIAC Computer.” Smithsonian. The term artificial intelligence (AI) wasn't coined until the midth century, but the idea of building intelligent systems has fascinated human beings for. The father of AI – John McArthy () John McCarthy is the highlight of our history of Artificial Intelligence. He was an American Computer Scientist, coined. Artificial Intelligence History The term artificial intelligence was coined in , but AI has become more popular today thanks to increased data volumes. Artificial intelligence (AI), the ability of a digital computer or computer-controlled robot to perform tasks commonly associated with intelligent beings. When was artificial intelligence invented? The term 'artificial intelligence' was first coined at a conference at Dartmouth College, in Hanover, New Hampshire. In the beginning, Artificial Intelligence was developed on the basis of neural networks. In , Frank Rosenblatt went on to create Perceptron. In the late s and early s, the development of the first electronic computers provide the necessary hardware basis for AI research. The creation of the.

The timeline begins in the s and s, where the foundational blocks of AI were laid with the conceptualization of artificial neurons. It. Here's a brief history of artificial intelligence. If you search the events online, you will find that each result provides a slightly different list of key. The inception of AI occurred in the s and marked a new field of study for computer science. Visionaries like Alan Turing, famed for his code-breaking. The term 'artificial intelligence' was created by the American mathematician John McCarthy, who in invited interested fellow countrymen to The Dartmouth. John McCarthy coined the term "artificial intelligence" in and drove the development of the first AI programming language, LISP, in the s. Early AI. A Brief History of AI in Education · PLATO: Ed-tech with Ai Capability, launched in · Machine Learning in Action · Gradescope by Turnitin. Wooldridge's A Brief History of Artificial Intelligence is an exciting romp through the history of this groundbreaking field--a one-stop-shop for AI's past. PDF | □ In this brief history, the beginnings of artificial in- telligence are traced to philosophy, fiction, and imagination. Early inventions in. Semantic Scholar extracted view of "A brief history of AI: how to prevent another winter (a critical review)" by Amirhosein Toosi et al. The term "artificial intelligence" (AI) was first coined in by John McCarthy and Marvin Minsky, who hosted an 8-week workshop at Dartmouth College;. history of artificial intelligence (AI) · Alan Turing and the beginning of AI · Theoretical work · Chess · The Turing test · Early milestones in AI · The first AI. History of Artificial Intelligence · Year The first work which is now recognized as AI was done by Warren McCulloch and Walter pits in · Year history of AI that carry similar themes. Overall we see a field pulled in two directions – one toward short term practical applications and the other toward. For a fairly long time, many experts believed that human-level artificial intelligence could be achieved by having programmers handcraft a sufficiently large. It all started in with Alan Turing. He was a young British polymath, who examined the mathematical prospect of AI. It was he who suggested that just like. The intellectual roots of AI, and the concept of intelligent machines, may be found in Greek mythology. Intelligent artifacts appear in literature since then. malaya-dubna.ru: How AI Ate the World: A Brief History of Artificial Intelligence - And Its Long Future: Stokel-Walker, Chris: Books. The theory behind AI, the concepts and mathematics behind the most prevalent algorithms, have been around for decades. Back in , Arthur Samuel created a. The timeline begins in the s and s, where the foundational blocks of AI were laid with the conceptualization of artificial neurons. It.

1 2 3 4 5